Advantages & Disadvantages

vs

Winning & Losing

&

Good & Bad

Advantages & Disadvantages

vs

Winning & Losing

&

Good & Bad

Monthly Income

Lifehacker – How to Measure Debt to Income Ratio

https://twocents.lifehacker.com/why-your-debt-to-income-ratio-matters-and-how-to-find-1822393275

“DTI ratio is a simple formula. Divide your monthly debt obligations divided by your gross monthly income, and multiply that number times 100,” says Lowry, who partnered with Turbo.

When you’re applying for a mortgage, be aware of something called your household ratio in addition to your DTI ratio (which can also be referred to as your back-end ratio.) Your household ratio is the amount of your home-related expenses (including property tax, prospective mortgage, insurance, etc.) divided by your monthly income.

“If your front-end DTI is below 28%, that’s great. If your back-end DTI is below 36%, that’s even better.”

Ideally, you want to keep your DTI at 36% or less,

Fast Company – Managing Money in the Gig Economy

https://www.fastcompany.com/40520552/how-to-manage-your-money-in-the-gig-economy

My favorite tip is the 50-20-30 rule. Here’s how it works: 50% or less of your spending should be on your critical essentials. Roof over your head, groceries, utility bills, transportation to and from work, and any health expenses that you have to pay. That helps you right-size how much your rent can be. Next, 20% goes toward the future—saving for retirement, saving for kids. Finally, 30% or less is your lifestyle. That’s going out, Zara, exercise, travel. That’s a really good litmus test. If I see your budget and I see your rent is 60% of what you make, it’s the clearest sign possible that you’re not going to be financially fit.

we recommend that you put your money automatically into a bank account and retrofit a standard paycheck to yourself [using your projected income as a guide].

The bare minimum, you need to do what I call the monopoly test and pass basic financial security. First, you have to have no credit card debt. If God forbid something goes really wrong, it will grow very quickly. Second, you need to be contributing to retirement and have some way of making sure your retirement does not go to zero. And third, and most important, you have to have an emergency savings account. We don’t want you to be leaning on credit cards to finance your life

Always think about your taxes proactively. Take out the max, depending on your zip code, and put it in a different account. That’s where we find people get flat-footed.

I like to call it your “jobby,” your hobby job. What we’re seeing with millennials is a growing jobby economy, whether it’s teaching makeup or guitar lessons. You have teams of millennials who are augmenting their full-time job. The No. 1 thing millennials want is to save for is a vacation. The No. 2 thing is to pay off their student loans faster.

I’d prefer if your savings bucket was 25% or more. That said, even getting people to 20% is really hard.

Conversation

Strategy

Communication

Thinking

—–

Beyond a joke

https://www.campaignlive.co.uk/article/beyond-joke/1338695

If humour is a way of making it enjoyable to change our minds, it matters immensely. It matters because advertising is becoming progressively less and less funny. It also matters if we are to solve the most important behaviour change challenges of our time: say what you like about environmentalists, they aren’t exactly a barrel of laughs”

In Inside Jokes – Using Humour To Reverse-Engineer The Mind, the three authors, among them Daniel Dennett, propose that humour “evolved out of a computational problem that arose when our long-ago ancestors were furnished with open-ended thinking. Mother Nature – aka natural selection – cannot just order the brain to find and fix […] mis-leaps and near-misses. She has to bribe the brain with pleasure. So we find them funny.”

According to one theory, humour evolved as a kind of social behaviour change mechanism. A means for people to point out mistakes without getting punched in the face. (In King Lear, the fool is generally the only person who is talking any sense.)

Red Bull can tell you a lot about how people really choose a drink. In the same way Ray Kroc showed an extraordinary insight into the evolutionary psychology behind McDonald’s: “People don’t want the best burger in the world; they want a burger that’s just like the one they had last time.” We have evolved to like eating food we have survived eating before.

Over the past few years, I have become convinced that advertising or marketing is potentially a kind of Galápagos Islands for understanding evolutionary psychology. Just as the beaks of finches can reveal a great deal about physical evolution, so the patterns of human consumerism can help us reverse engineer a better understanding of what people really want, as distinct from what they say they want. Amos Tversky, the late research partner of Daniel Kahneman, remarked of his groundbreaking work that he “merely studied in a systematic way things about behaviour that were already known to advertisers and used-car salesmen”.

If we want to understand those black-box parts of the brain, conventional research alone won’t cut it. The black box operates through instinctive feelings rather than thoughts or words, and is largely “opaque to introspection”. Moreover, because it is the product of evolution and not design, you must often start with observable behaviours and reverse-engineer the underlying mechanisms from there.

Image: Hugh MacLeod. Gaping Void

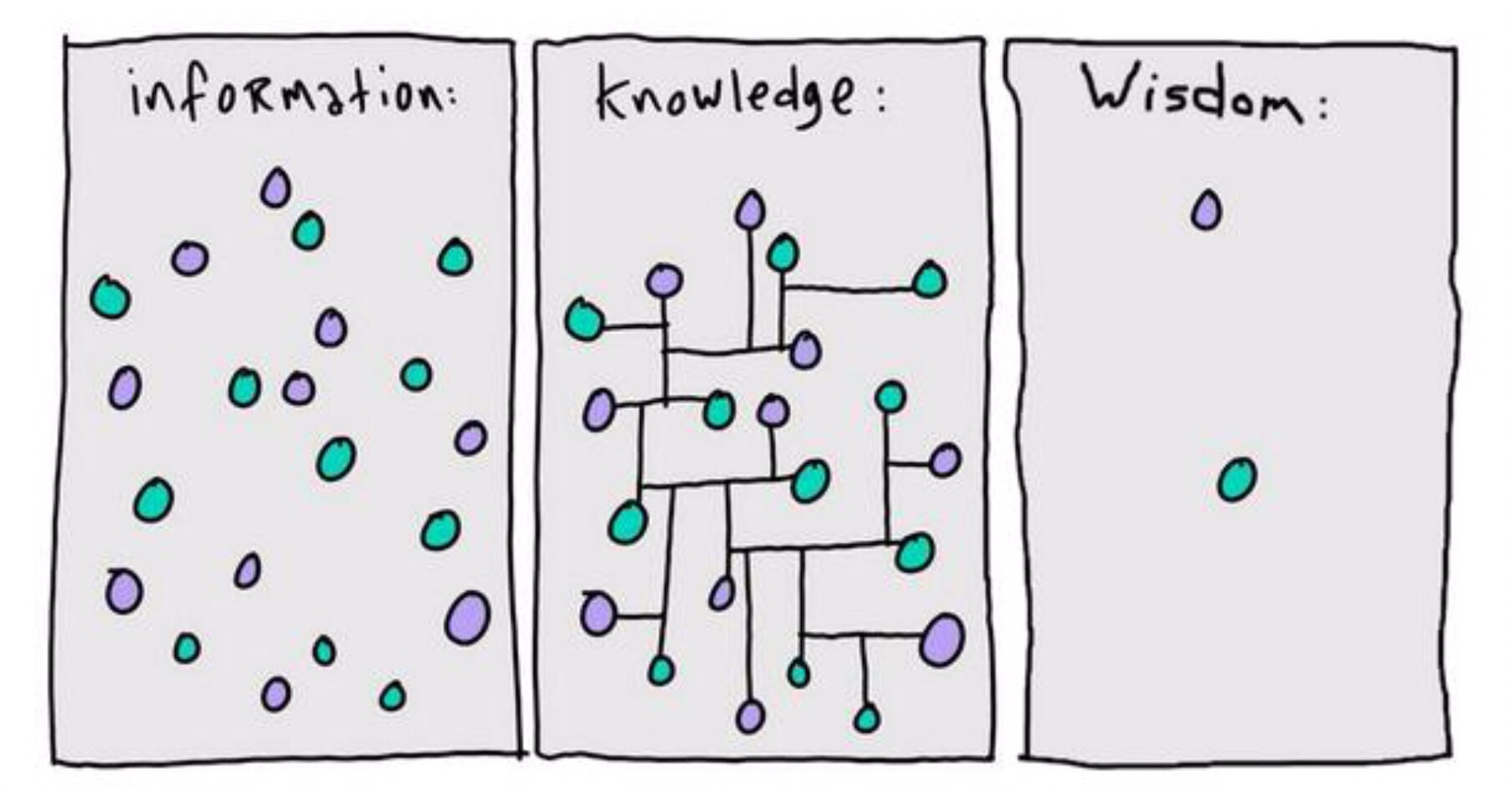

“To attain knowledge, add things every day; to attain wisdom, subtract things every day.” Lao Tsu

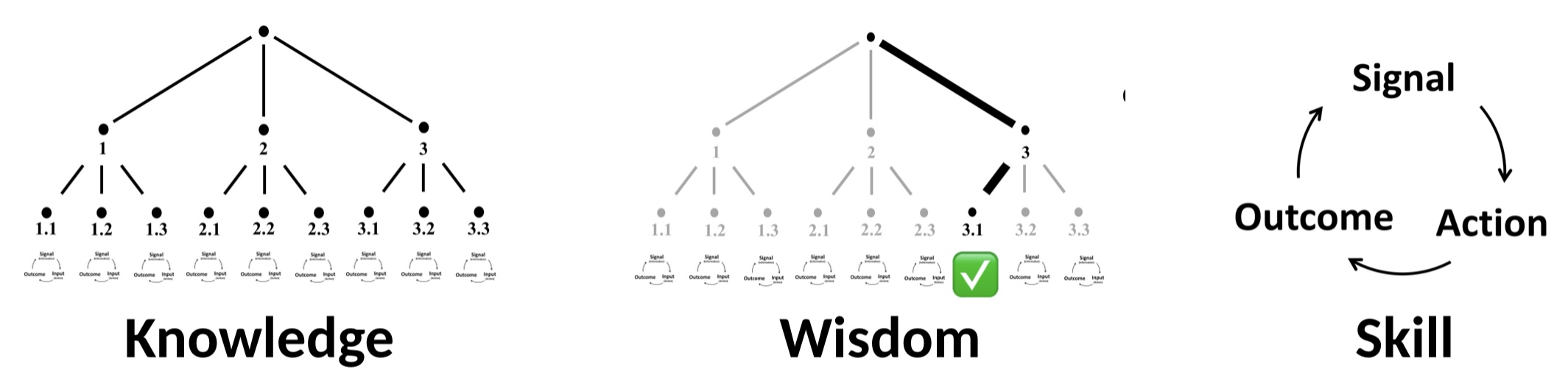

Knowledge is an understanding of how information is linked.

Wisdom is an understanding of context and what is important when.

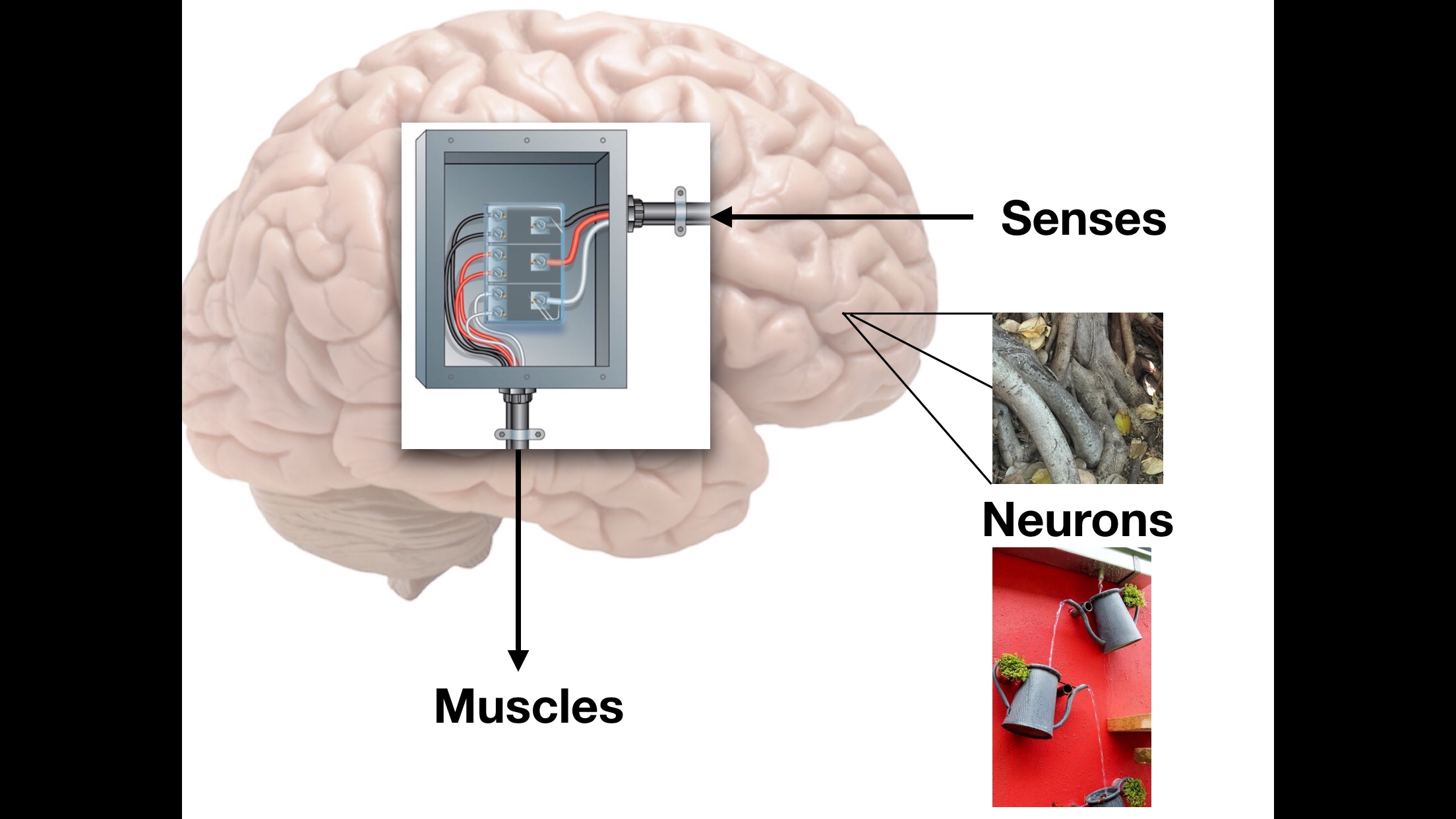

Skill is the ability to link signals to actions to generate outcomes within a relevant time frame.